Peptide Research and FDA Approval

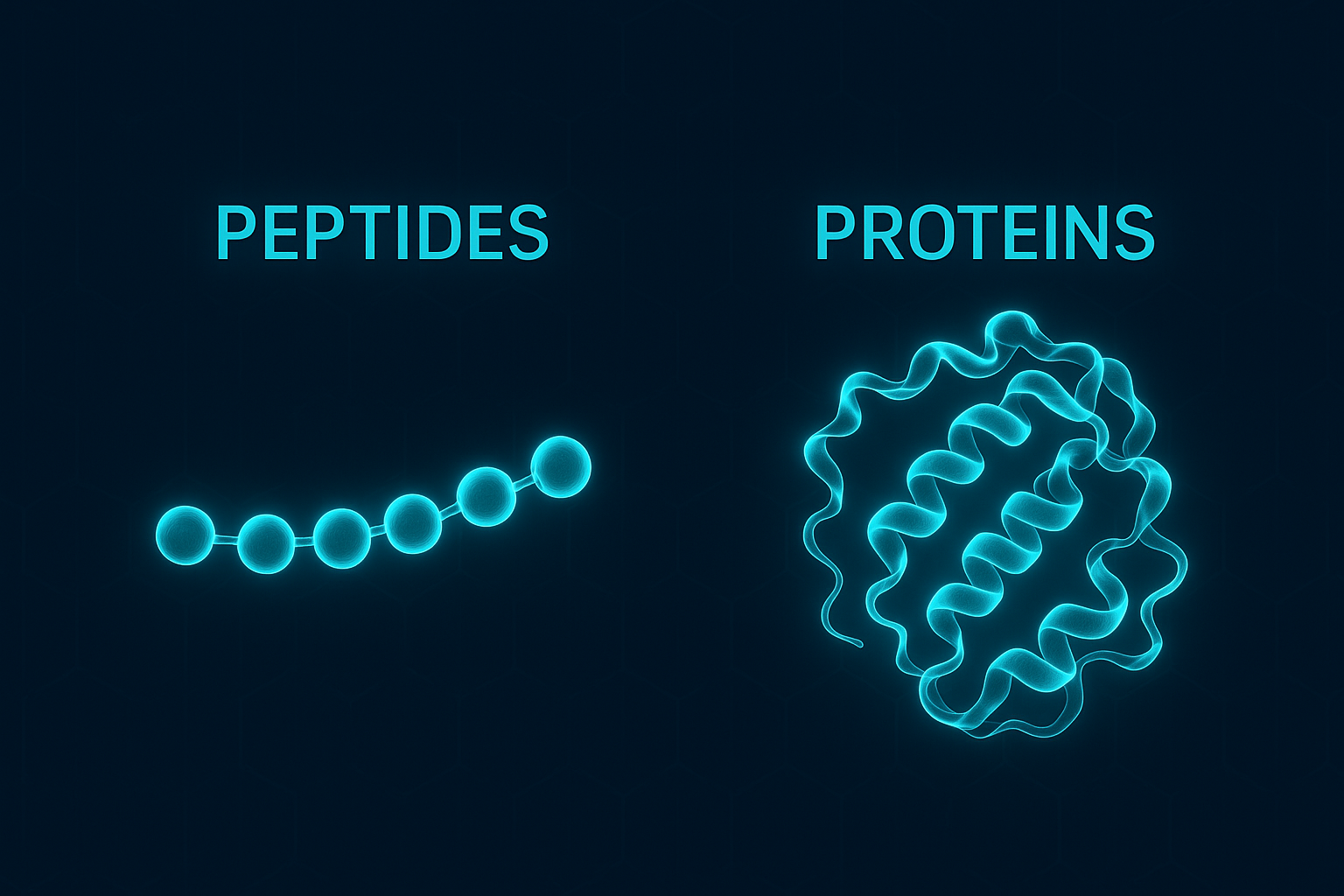

Peptides are short chains of amino acids—essentially miniature proteins—that act as highly precise messengers inside the human body. They regulate healing, metabolism, hormones, inflammation, immune function, and countless cellular processes. Because of their high selectivity and generally excellent safety profiles, peptides have become one of the fastest-growing areas of modern biomedical research.

However, it’s important to understand the difference between research peptides and FDA-approved peptide medicines, as well as the financial and regulatory barriers that influence which peptides eventually reach the market.

This article explains what research peptides are, how they differ from approved drugs, why they matter, and how the FDA approval process—along with its funding structure—affects which peptide therapies ultimately advance to patients.

1. What Are Research Peptides?

Research peptides are laboratory-synthesized peptides designed exclusively for scientific study. They are used in:

- In-vitro experiments (“in glass,” meaning outside a living body)

- Cell culture studies

- Receptor-binding tests

- Pharmacology experiments

- Toxicology assays

- Early-stage therapeutic discovery

These peptides are not medications. They have not been evaluated by the FDA, are not approved for treating any condition, and cannot legally be marketed as therapies.

Every FDA-approved peptide drug once began as a research peptide used in early laboratory experiments.

2. Research Peptides vs. FDA-Approved Medications

Research Peptides

- Used only in scientific and laboratory settings

- Not approved for human or veterinary treatment

- Not evaluated for safety or efficacy

- Serve as raw materials for early-stage research

FDA-Approved Peptide Drugs

- Have undergone years of clinical trials

- Proven safe and effective for specific conditions

- Can be prescribed legally by healthcare providers

- Examples include:

- Leuprolide (Lupron™) – prostate cancer

- Liraglutide (Victoza™) – type 2 diabetes

More than 60 peptide medicines are FDA-approved today, with several generating billions in annual revenue. However, until a peptide completes the FDA’s rigorous approval pathway, it remains strictly a research material.

3. Why Peptides Are Promising for Future Medicine

Over 7,000 natural peptides have been identified in the human body. These molecules function as:

- Hormones

- Neurotransmitters

- Immune signals

- Growth factors

- Antimicrobials

Peptides are scientifically attractive because they tend to be:

- Highly selective

- Potent at very small doses

- Well tolerated

- Rapidly metabolized

- Less likely to cause systemic toxicity

Major growth areas for peptide research include:

- Obesity and diabetes

- Cancer (oncology)

- Inflammation

- Infectious diseases

- Rare genetic disorders

- Regenerative medicine

- Vaccination and diagnostics

Peptides hold enormous potential, but turning research peptides into real therapeutic medicines is a long and costly journey.

4. FDA Approval: Timelines, Costs, and Barriers

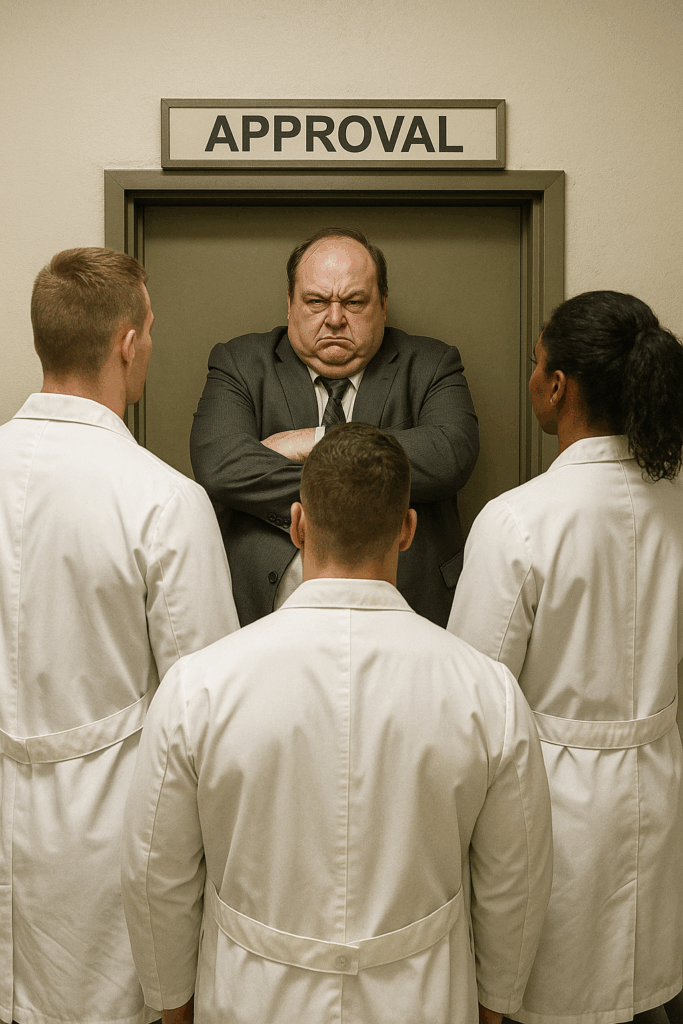

Developing a peptide drug requires navigating the FDA’s multi-step approval process. While these steps protect public safety, the high costs and long timelines limit who can participate in drug development.

4.1 The FDA Approval Process (Simple Breakdown)

| Stage | Purpose | Typical Duration | Approx. Cost |

| Preclinical Research | Lab and animal testing | 1–3 years | $1–5 million |

| IND Application | FDA permission for human trials | Months | $100k–$500k |

| Phase 1 Trial | Tests safety in healthy volunteers | 1–2 years | $2–10 million |

| Phase 2 Trial | Tests efficacy + dosing | 2–3 years | $10–50 million |

| Phase 3 Trial | Large-scale confirmation | 3–5 years | $50–300+ million |

| FDA Review | Final FDA evaluation | 1–2 years | $2–5 million |

Total timeline: 7–12 years

Total cost: $100 million to >$1 billion

Only large pharmaceutical companies typically have the resources to move a peptide from early discovery to approved medication.

5. How FDA Funding Creates Conflicts of Interest

Many assume the FDA is funded primarily by taxpayers. This is true for some divisions, but not for the division that reviews new drugs.

The FDA’s Center for Drug Evaluation and Research (CDER)—the part that approves new medications—is funded mostly by user fees paid by pharmaceutical companies under the Prescription Drug User Fee Act (PDUFA).

Independent analyses confirm:

- ~75% of the drug-review budget is funded by industry fees¹

- 66% of human-drug program costs came from user fees in FY2022²

- 65% of human-drug regulatory activities are industry-funded³

The companies being regulated provide most of the funding for the regulators—creating what many experts call a “structural conflict of interest.”

5.1 Why This Creates Obstacles for Peptide Research

5.1.1 Financial Gatekeeping

Early-stage biotech and academic labs often cannot afford:

- User fees

- Preclinical requirements

- Clinical trial cost

As a result, many promising peptides never reach human trials.

5.1.2 Patentability Problems

Natural peptides often cannot be patented unless chemically modified.

Pharma companies hesitate to invest hundreds of millions into a molecule they cannot monopolize for 20 years.

5.1.3 Competition With Existing Billion-Dollar Drug Markets

Peptides often have mechanisms that could compete with current high-revenue drugs. For companies and investors, this creates economic disincentives.

Several major drug markets generate enormous annual revenues:

- GLP-1 agonists for diabetes + obesity (Ozempic, Wegovy, Mounjaro):

>$50 billion projected annual market by 2030

Ozempic alone exceeds $18 billion per year. - Autoimmune biologics (Humira, Enbrel, Stelara):

Humira peaked at >$20 billion per year; the biologics market exceeds $170 billion annually. - Cancer therapeutics:

Multiple oncology drugs generate $10–15 billion per year each; the overall cancer drug market is >$200 billion annually. - Anti-inflammatory and pain drugs:

Tens of billions in combined annual revenue.

Any peptide capable of affecting inflammation, metabolic signaling, immune modulation, or tissue repair can threaten these markets.

Given that the same companies fund a majority of the FDA’s drug-review budget, their economic interests shape which drugs receive:

- investment,

- trial funding, and

- commercialization support

5.1.4 The “Valley of Death” Between Research and Approval

Thousands of peptides show promising lab or animal results, but most never reach clinical trials because financier incentives favor:

- large, patent-protected markets

- high revenue potential

- low regulatory friction

Peptides, being inexpensive and often non-patentable, frequently fall into this gap.

6. Summary

- Research peptides are tools for laboratory experiments—not medicines.

- FDA-approved peptide drugs exist, but take 7–12 years and >$100 million to bring to market.

- A large portion of the FDA’s drug-review budget is funded by pharmaceutical companies, not taxpayers.

- This creates structural barriers for independent researchers.

- Many promising peptides never reach clinical trials, even when early evidence is strong.

Peptides remain one of the most promising therapeutic frontiers—but the path from research to FDA-approved therapy is shaped by financial, regulatory, and political realities.

References

- Congressional Research Service. FDA Regulation of Pharmaceutical Marketing: Overview and Issues. R44750. Published 2023. Accessed January 2025. https://crsreports.congress.gov/product/pdf/R/R44750

- National Academies of Sciences, Engineering, and Medicine. Prescription Drug User Fee Act (PDUFA): Examining the Impact of User Fees on Drug Development. NCBI Bookshelf. Published 2023. Accessed January 2025. https://www.ncbi.nlm.nih.gov/books/NBK603243/

- University of Connecticut. Why Is the FDA Funded in Part by the Companies It Regulates? Published May 2021. Accessed January 2025. https://today.uconn.edu/2021/05/why-is-the-fda-funded-in-part-by-the-companies-it-regulates-2/